Introduction:

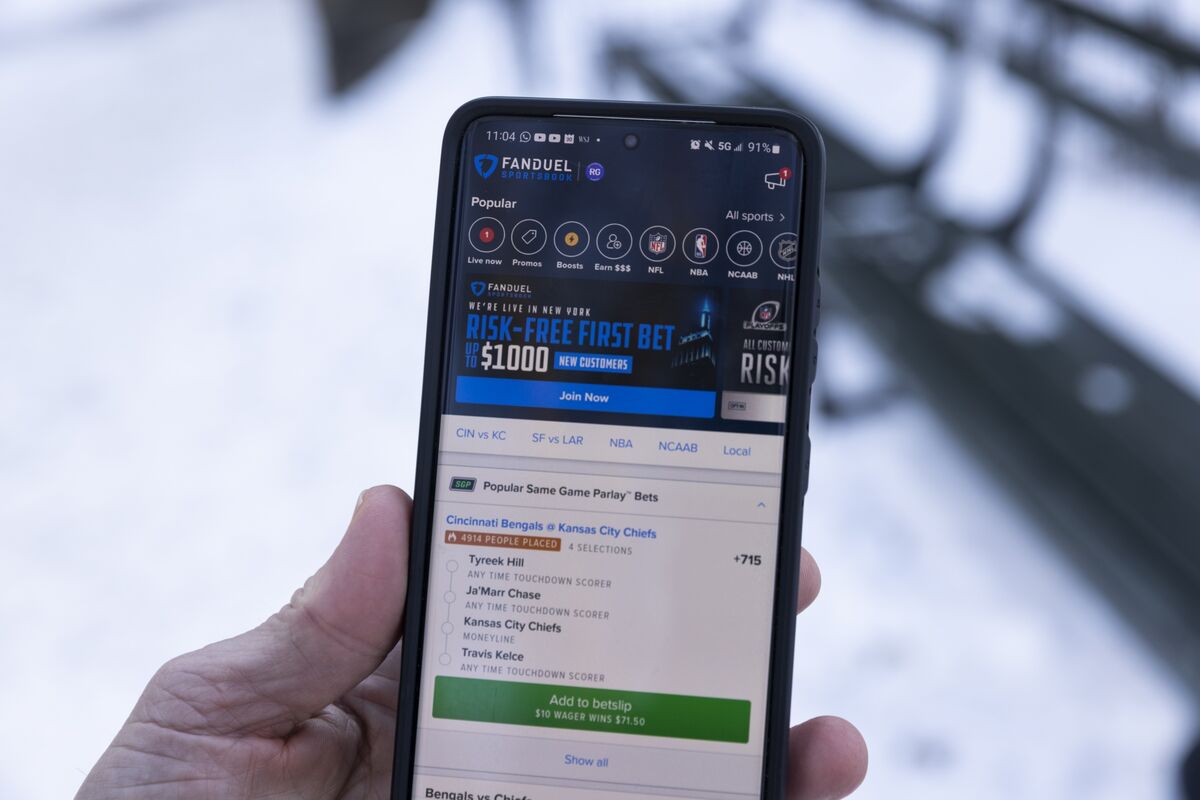

FanDuel is one of the leading daily fantasy sports platforms in the United States. With its increasing popularity, many users wonder how much they can withdraw from FanDuel without paying taxes. In this article, we will explore the regulations and guidelines surrounding withdrawals from FanDuel and provide an answer to this question.

Understanding Taxes on FanDuel Withdrawals:

The Internal Revenue Service (IRS) requires individuals to pay taxes on any income they receive, including earnings from gambling activities. This applies to any winnings from 메이저도메인 as well. According to the IRS, any winnings from gambling activities exceeding $600 in a year are considered taxable income.

Taxes on FanDuel withdrawals are similar to other types of gambling winnings and are subject to federal and state income taxes.

Here are some key points to understand about taxes on FanDuel withdrawals:

Reporting winnings: FanDuel is required by law to report any winnings of $600 or more to the IRS, and users are required to report all winnings on their tax return.

Tax rates: The federal tax rate on gambling winnings is 24%, while state tax rates vary. Some states do not have a state income tax, while others may have tax rates as high as 8%.

Deductions: Taxpayers can deduct gambling losses up to the amount of their winnings, but only if they itemize their deductions on their tax return.

Withdrawal Limits on FanDuel:

FanDuel has set its own withdrawal limits that dictate the amount a user can withdraw from their account. Currently, the minimum amount for withdrawal is $10, and the maximum amount varies depending on the withdrawal method. For example, a user can withdraw up to $2,000 per day using PayPal, while the maximum daily withdrawal limit for ACH transfers is $5,000. FanDuel may also require additional documentation or verification before approving a withdrawal.

Tax Implications on FanDuel Withdrawals:

As mentioned earlier, the IRS requires individuals to report any gambling winnings exceeding $600 in a year as taxable income. This means that any winnings from FanDuel above this threshold will be subject to taxes. It is important to note that FanDuel will issue a Form 1099-MISC to users who have won over $600 in a calendar year. This form is used to report miscellaneous income, including gambling winnings, to the IRS.

Furthermore, FanDuel does not withhold any taxes from winnings, so users are responsible for keeping track of their earnings and reporting them on their tax returns. It is recommended that users consult with a tax professional to ensure compliance with tax laws and regulations.

Withdrawal Methods and Tax Implications:

As previously mentioned, the maximum withdrawal amount varies depending on the method chosen by the user. However, it is important to note that the withdrawal method chosen may also have tax implications. For example, if a user chooses to withdraw their funds through PayPal, they may incur a transaction fee. This fee is not tax-deductible and cannot be included in the 메이저도메인 of goods sold or expenses related to the winnings.

On the other hand, ACH transfers may not have any transaction fees, but they may take longer to process. Additionally, ACH transfers may not be available in all states, so users should check their state’s laws and regulations before choosing this method.

Conclusion:

In conclusion, the amount a user can withdraw from FanDuel without paying taxes is dependent on the earnings they have accumulated. According to IRS regulations, any gambling winnings exceeding $600 in a year are considered taxable income. FanDuel has set its own withdrawal limits, which vary depending on the method chosen by the user. It is important to note that the withdrawal method may also have tax implications, and users should consult with a tax professional to ensure compliance with tax laws and regulations.